|

|

|

Bar-G Feedyard

Local Auction Info.

Market Data

News

Commentary

Weather

Resources

|

Is Seagate Technology Stock Outperforming the S&P 500?/Seagate%20Technology%20Holdings%20Plc%20logo%20magnified-by%20Casimiro%20PT%20via%20Shutterstock.jpg)

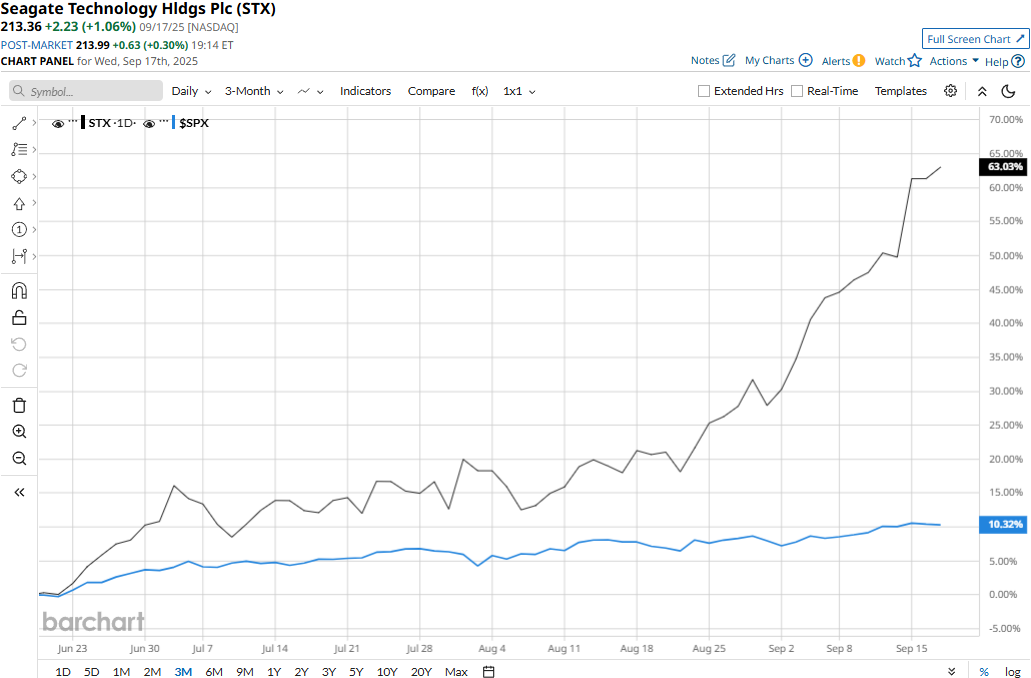

Singapore-based Seagate Technology Holdings plc (STX) engages in the provisioning of data storage technology and infrastructure solutions in Singapore, the U.S., and internationally. With a market cap of approximately $45 billion, Seagate operates as one of the largest manufacturers of hard disk drives (HDDs) in the world. Companies with a market cap of $10 billion or more are categorized as "large-cap stocks." Seagate fits this description perfectly, with its market cap exceeding this threshold, reflecting its substantial size and influence in the SSD and HDD storage market. STX touched its all-time high of $215.20 on Sept. 16 and is currently trading 85 bps below that peak. Meanwhile, the stock has soared 63% over the past three months, notably outperforming the S&P 500 Index’s ($SPX) 10.3% gains during the same time frame.

Seagate’s performance has remained impressive over the longer term as well. The stock has surged 147.2% on a YTD basis and 109% over the past 52 weeks, outperforming SPX’s 12.2% uptick in 2025 and 17.1% gains over the past year. Moreover, the stock has traded consistently above its 50-day moving average since late April and above its 200-day moving average since early May, underscoring its bullish trend.

Despite delivering more-than-impressive results, Seagate’s stock prices dropped 3.5% in the trading session following the release of its Q4 results on Jul. 29. The company has observed rapid demand growth for its mass data storage products, leading to a massive 29.5% year-over-year surge in revenues to $2.4 billion, surpassing the Street expectations by 1.6%. Moreover, the company reported record gross margin, and its non-GAAP EPS came in at $2.59, up 146.7% year-over-year, surpassing the consensus estimates. However, the company’s guidance for Q1 FY26 missed the Street’s projections. Nevertheless, following the initial dip, Seagate’s stock prices shot up 6.5% in the subsequent trading session. When compared to its peer, STX has also outperformed Western Digital Corporation’s (WDC) 125.7% surge in 2025 and 104.3% gains over the past year. Among the 22 analysts covering the STX stock, the consensus rating is a “Moderate Buy.” As of writing, the stock is trading significantly above its mean price target of $174.26. On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|